Showing 169–180 of 252 results

-

$84.00

IISBN-10: 1-891249-41-XLast Updated: 2019Author: Michael Laden Overview This CTPAT compliance book was designed to be your single source for CTPAT information and a roadmap on how to build a credible program. The author of this book was involved in the development of the CTPAT program. He guides you through the do’s and don’ts of how…

-

$105.00

ISBN-10: 1-891249-80-0ISBN-13: 978-891249-80-8Last Updated: 2022Authors: George Thompson & Catherine J Petersen Overview Order “Managing Forwarders, Brokers & Carriers” today for a thorough trade resource. Once your company has made the sale or the purchase, it must make certain that merchandise conforming to the terms of the contract is sent to, and arrives at, the point…

-

$79.00

ISBN-10: 1-891249-62-2ISBN-13: 978-1-891249-62-4Last Updated: 2022Author: Trudy Wilson Overview This Mexico international trade guide aims to present an overview of the processes involved in cross-border exportation between the U.S. and Mexico. It addresses U.S. export, U.S./Mexico cross-border, and Mexican import requirements. The reference book will help you understand the process and requirements for completing U.S. exports…

-

-

$125.00

$125 fee for transfers or cancellations CAN’T MAKE YOUR SCHEDULED SEMINAR/WEBINAR? You may send a substitute even at the last minute at no charge. For a refund, the cancellation notice must be received in writing thirty (30) or more days prior to the seminar date. Please send cancellation notice to contact@globaltrainingcenter.com. No refunds will be granted for…

-

$60.00

$125 fee for transfers or cancellations CAN’T MAKE YOUR SCHEDULED SEMINAR/WEBINAR? You may send a substitute even at the last minute at no charge. For a refund, the cancellation notice must be received in writing thirty (30) or more days prior to the seminar date. Please send cancellation notice to contact@globaltrainingcenter.com. No refunds will be granted for…

-

Sale!

$49.00 $39.00

The Bureau of Industry and Security (BIS) continues to impose and add to expansive export controls against Russia & Belarus covering both U.S.-origin products and numerous items made abroad. Sanctions were effective immediately, therefore no grace period was granted. This one-hour Russia Sanctions: Compliance & Consequences course will outline the new export controls and what exporters, re-exporters, and in-country transferors need to know.

Connection Email will be sent a few days before the course date.

Date: June 20, 2024

Start time: 10:00 a.m. CDT

End time: 11:00 a.m. CDT

Phone: 915-534-7900

Email: contact@globaltrainingcenter.com

-

$595.00

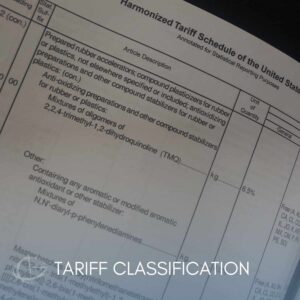

Classification for import, export, FTA determination & clarification on Section 301 and Section 232. The classification & valuation of goods are major decisions! Critical information not only for duty purposes but also to determine whether goods are subject to quotas, restraints, embargoes, or other restrictions. Shipments with incorrect classifications may not reach their destination and/or you may be subjected to penalties

-

$595.00

Classification for import, export, FTA determination & clarification on Section 301 and Section 232. The classification & valuation of goods are major decisions! Critical information not only for duty purposes but also to determine whether goods are subject to quotas, restraints, embargoes, or other restrictions. Shipments with incorrect classifications may not reach their destination and/or you may be subjected to penalties

-

$595.00

Classification for import, export, FTA determination & clarification on Section 301 and Section 232. The classification & valuation of goods are major decisions! Critical information not only for duty purposes but also to determine whether goods are subject to quotas, restraints, embargoes, or other restrictions. Shipments with incorrect classifications may not reach their destination and/or you may be subjected to penalties

-

$595.00

Classification for import, export, FTA determination & clarification on Section 301 and Section 232. The classification & valuation of goods are major decisions! Critical information not only for duty purposes but also to determine whether goods are subject to quotas, restraints, embargoes, or other restrictions. Shipments with incorrect classifications may not reach their destination and/or you may be subjected to penalties

-

$595.00

Classification for import, export, FTA determination & clarification on Section 301 and Section 232. The classification & valuation of goods are major decisions! Critical information not only for duty purposes but also to determine whether goods are subject to quotas, restraints, embargoes, or other restrictions. Shipments with incorrect classifications may not reach their destination and/or you may be subjected to penalties