Harmonized Tariff Schedule of United States 2019

The United States International Trade Commission (USTIC) has released the 2019 Harmonized Tariff Schedule that went into effect January 1, 2019.

Click here to view current version

or

The United States International Trade Commission (USTIC) has released the 2019 Harmonized Tariff Schedule that went into effect January 1, 2019.

Click here to view current version

or

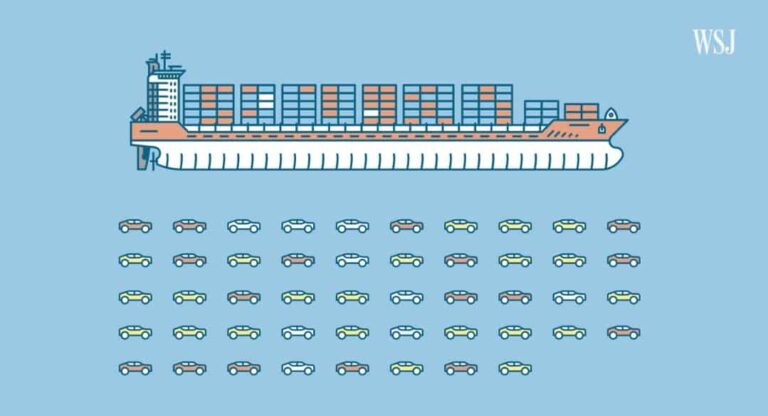

Working in logistics and transportation requires a wide range of skills to deal with the different service providers. Helping you move the product across the globe. Get the training you need to become efficient and productive with Logistics and Transportation. Check out our training events here. Transcript from video from WSJ. Follow link below to…

US authorities have recently warned trade finance lenders that they may be unknowingly facilitating exports of sanctioned goods to Russia, with funds potentially moving through the US financial system. The Kremlin’s intelligence service has reportedly been tasked with finding ways to circumvent sanctions and export controls to replace military equipment damaged in its war with…

The Foreign-Direct Product Rule is a provision of the Export Administration Regulations The following transcript from George W. Thompson, explains the criteria under which some foreign products are subject to the EAR and are thereby within the scope of export controls even if they have no physical U.S. origin content. Hello again, this is George…

By Makada Henry-Nickie The evolution of workforce opportunity in the United States depends on the future of education and our commitment to far-reaching, equitable federal reform. Unfortunately, policy conversations at the federal and state levels about transforming education systems to meet future workforce demands have focused disproportionately on a skills agenda, largely ignoring behavioral competencies that…

When nations engage in trade with each other, their governments use a Tariff Classification system for several reasons. Classifying tariffs allows governments a means to standardize duty and tax collection, enforce laws and international treaties, accumulate data for commercial and economic planning and conduct international trade negotiations. Conversely, companies that import and export goods have…

In most of the world and, indeed, in much of the United States the parties to a transaction often do not know each other and are concerned that the transaction will not proceed without problems. The manufacturer or supplier is concerned that it will not be paid for goods or services rendered. The buyer is…