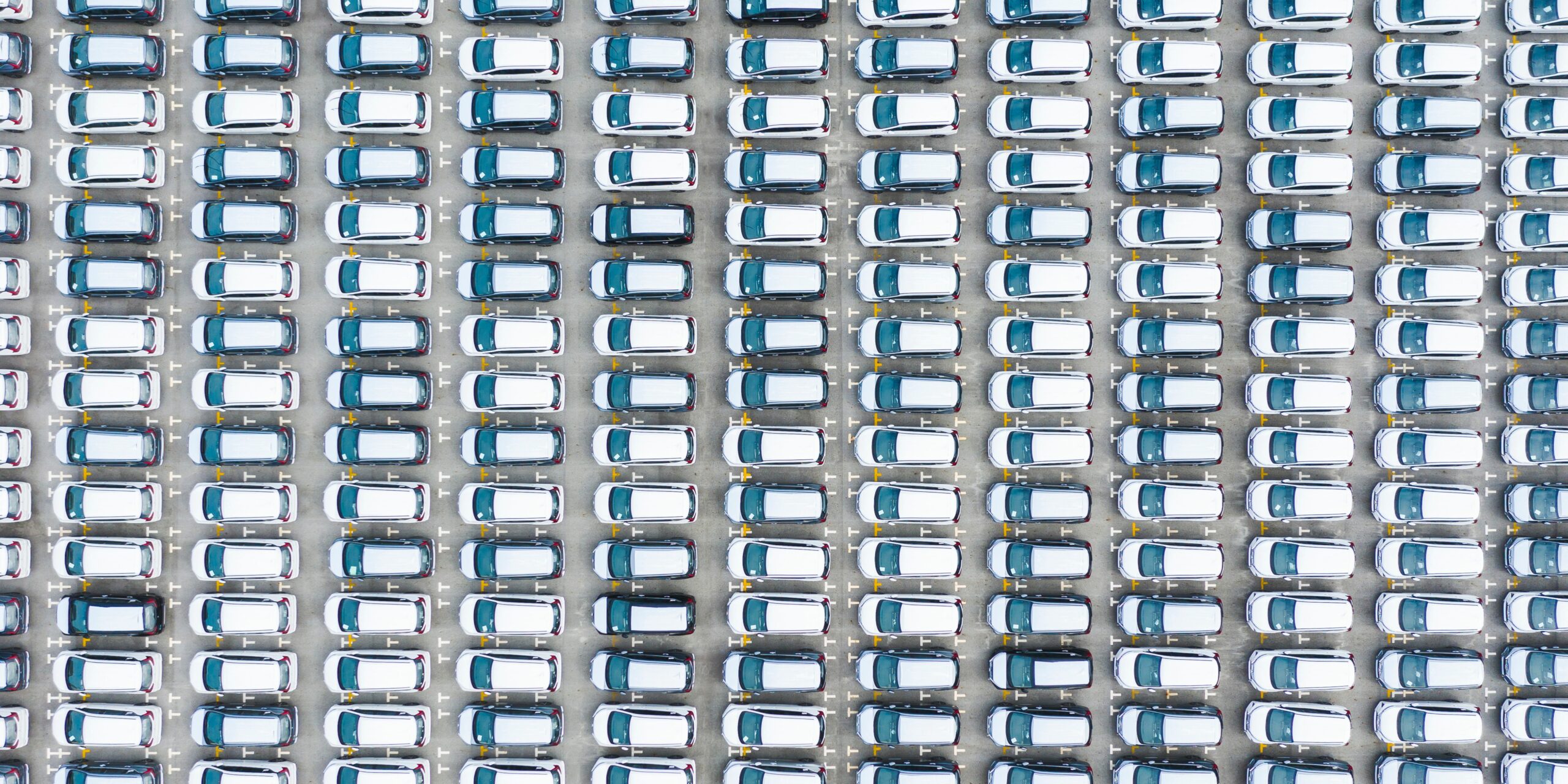

Chinese Carmakers Ride a Wave into European Ports

As the automotive industry continues to evolve, the rise of Chinese carmakers and their expansion into international markets is becoming increasingly evident. In a recent report by Automotive Logistics, it is clear that China is targeting Europe for electric vehicle (EV) sales, leveraging the recovery of roll-on/roll-off (ro-ro) capacity and navigating geopolitical disruptions. European ports are witnessing a surge in Chinese vehicle imports, with both deep ocean pure car and truck carriers (PCTCs) and containerized vehicles making their way to Europe. This trend comes at a time when traditional shipping routes are facing disruptions, leading to longer delivery schedules. In this blog, we will delve into the key findings of the report and explore how this wave of Chinese carmakers is impacting European ports and logistics.

Increasing Chinese Vehicle Imports:

Europe’s top vehicle-handling ports reported a significant increase in Chinese vehicle imports, a trend that is expected to continue in 2024. The surge in imported vehicles is attributed to new carmakers targeting the European market and the transition to electric vehicles, which has enticed dominant Chinese EV manufacturers to aim their products at Europe. However, the recent disruptions in the shipping industry, including attacks in the Red Sea and Gulf of Aden, have led to some vessel operators diverting shipments around South Africa’s Cape of Good Hope, resulting in delays of up to 15 days.

Capacity Challenges and Terminal Constraints:

As the ro-ro shipping sector continues to recover from capacity shortages, European vehicle terminals are facing challenges in delivering vehicles efficiently. The scarcity of road haulage drivers and finished vehicle equipment, coupled with the longer dwell times caused by larger volume deliveries, has exacerbated the terminal capacity constraints. Nevertheless, certain ports have managed to overcome these challenges by relying on improved rail services, which not only enhance efficiency but also align with sustainable logistics goals.

Automation and Sustainable Logistics:

To address the capacity shortage and enhance sustainability, ports such as Antwerp-Bruges have implemented automation in their rail classification processes. The rail bundling project focuses on transporting rail tank cars for liquid commodities, with the aim of diverting short and long-haul tractions efficiently. Furthermore, vehicle terminals have started creating larger strategic stock to facilitate faster deliveries to end customers, as more buyers prefer online methods of purchasing vehicles. By embracing direct sales through online platforms and establishing long-term partnerships with transport providers, carmakers are streamlining their operations and reducing reliance on traditional dealer networks.

Chinese EV Imports and Containerization:

The rise in EV imports from China has compelled European ports to adapt to the changing landscape. The port of Antwerp-Bruges has observed a substantial growth in total car imports from China, with containerized vehicles becoming a preferred mode of transportation due to capacity constraints in the ro-ro sector. Barcelona’s port has also experienced an increase in containerized EV shipments from China, alongside a significant rise in ro-ro imports. Notably, around 80% of the Chinese imported vehicles in 2023 were electric or hybrid, reflecting the emphasis on sustainable mobility.

Rail as a Green Logistics Solution:

To mitigate challenges in road-based vehicle movements, ports are increasingly relying on rail transportation. Barcelona’s port, for instance, has established UIC rail infrastructure and has successfully handled thousands of vehicles by rail, connecting with Central European countries like Germany, Austria, and France. This shift towards rail transport aligns with the port’s commitment to becoming a greener hub for vehicle imports from China and exports to Europe.

The influx of Chinese carmakers into the European market is reshaping the dynamics of the automotive industry, particularly in terms of EV imports. As Chinese automakers target Europe and leverage recovering ro-ro capacity, European ports are witnessing an increase in Chinese vehicle imports. Although capacity constraints and logistical challenges persist, ports are adapting by implementing automation, relying on rail transportation, and embracing sustainable practices. With the automotive landscape continuously evolving, it remains crucial for stakeholders to stay agile and explore innovative solutions to overcome future challenges in vehicle logistics.

Read article source: https://www.automotivelogistics.media/finished-vehicle-logistics/chinese-carmakers-ride-a-wave-into-european-ports/45367.article

Exporting Procedures Course

This Exporting Documentation and Procedures Course is a must for all exporters. Our expert instructor provides you with practical Do’s and Don’ts of Exporting that will deepen your understanding of the process. With our comprehensive text as your day-to-day resource, you’ll be equipped to handle every aspect of exporting with ease. We update our Exporting course annually to ensure it reflects current practices and regulations, so you can be confident that you’re staying ahead of the curve.